Understanding 'Zerodha'

Deep-diving into the multiple sections available on Zerodha.

Welcome again! We analysed Groww in our first article and are today back with this arch-rival, Zerodha. Without wasting any of your time, we'll be picking up different segments of the user journey and deep-diving into each one of them.

Let's start with onboarding. It is a seven-step process, and you might need assistance from the internet if you are a first-timer in this space. Below are a few important key takeaways.

Downloading - through the Zerodha website, I initially got confused and downloaded KITE, but it redirects you to Zerodha.

Charging customers upfront according to the segments that they will opt for. (how would I know if I want a commodity or not?)

Standard KYC verification (photo, PAN, e-sign), and you would also need to upload a cancelled check; hmm.

Apart from that one step where users are charged upfront, overall onboarding is smooth, and you will get your account ready in less than 24-40 hours.

You can also open your account by offline methods -

Request a callback from Zerodha. A sales manager will send you the account opening forms via email and take the process forward.

Visit the zerodha.com website. Download the application forms. Print, fill and sign it. Courier it to the company address mentioned in the form along with necessary documents.

Note: The account opening fee for an offline account is Rs 400, and that for an online account is Rs 200.

Next comes logging in. It has two-factor manual authentication for first-time logins, and then it saves your User ID and password. You need to enter the pin from next time onwards, which can be replaced with a face-ID or touch-ID. Nice!

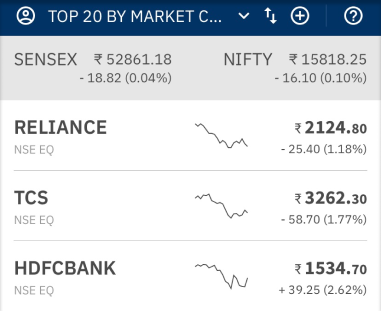

And then you land on the Marketwatch, the homepage. You can have multiple watchlists (up to 5) in the ‘BIG Marketwatch’ section of the app. Marketwatch written on there is literally so big that it wastes that space. In the investing world where every visual detail matters, that big Marketwatch annoys me and some other users (Google and App Store reviews).

The interesting thing to note here is that you can literally add anything from the search option. Equity, Option, Index etc. (Universal search used well and at the right place!). Nice.

There is also an icon just in line with BIG MARKETWATCH, something like a drop-down where you can see overviews for market indices. It seems okay, but why not use that ‘BIG MARKETWATCH’ space for tracking market indexes? (Inspiration - Upstox)

When you select a stock from the universal search, you can have a very detailed snapshot of that stock. Metrics like - current value, trend, market depth, and many more. Really impressive! Charting options are also available, but I won't deep dive into the trading arena for now. Let's stick to the long-term equity investment use case for this edition. The thing that makes this section different from competitors and powerful is the presence of third-party app integration in the snapshot view. Fundamentals, Set an alert, technicals, Stockreports+- are all amazing plugins.

Selling or buying is fairly simple, and I don't think it changes much for any stockbroker application.

Let's understand the dashboard now. A very conventional dashboard with a filtered view that won't let you save your filter view. Every time you open the app, it simply forgets your saved filter. For someone who actively invests in multiple stocks, they can find this limitation irritating.

Next comes the console. How can you not talk about consoles when you are talking about Zerodha. The console is the central dashboard where you can - place withdrawal requests, keep track of credits and debits in your trading account via your account statement, view and track your portfolio of positions, stocks and mutual funds. So basically, a dashboard made of different dashboards. Apart from a very different UI (and poor) than Kite, the console is not at all mobile-friendly though it does provide some excellent pivots for all your investments on Zerodha.

Let's understand the 'Help and Support' section. Help and Support is one of the major verticals for fintech apps, and why would it not be. Brokers care less about UI and design and more about the speed of function and customer support. This vertical is definitely ripe for disruption; the industry not only needs efficient solutions to all the customer issues but they need to be quick as hell. Apart from the conventional set of ticket-based issue resolution, email and free phone support that are almost supported in every other financial app, these apps need some sort of premium customer care service that can resolve important issues (complaints involving large sums of money) quickly. Maybe a paid call support, I won't mind a 10-12 Rs/min for lakhs of investments I made into equity.

Talking about widgets, Kite doesn't support any widgets as of now, and I am not really sure about android; maybe it does have a widget to show your current holding but nothing much. What ‘Janta’ wants is a widget for updates regarding market indices, among others. Sounds cool but hard to implement, iOS does not refresh data in the background for widgets, and widgets are generally static.

That was all about today. We’ll be seeing you again with another app and another teardown. Until then, if you liked today’s article and found it helpful please share ‘Understanding Nuances’ among your friends and peers!

Probable answer to the BigMarket watch q is that they advocate not checking up on movements on a very short level time frame.

Probably.